tax identity theft occur

Ad Credit Monitoring Locking at Your Fingertips. Trust the 1 Most Recognized Brand.

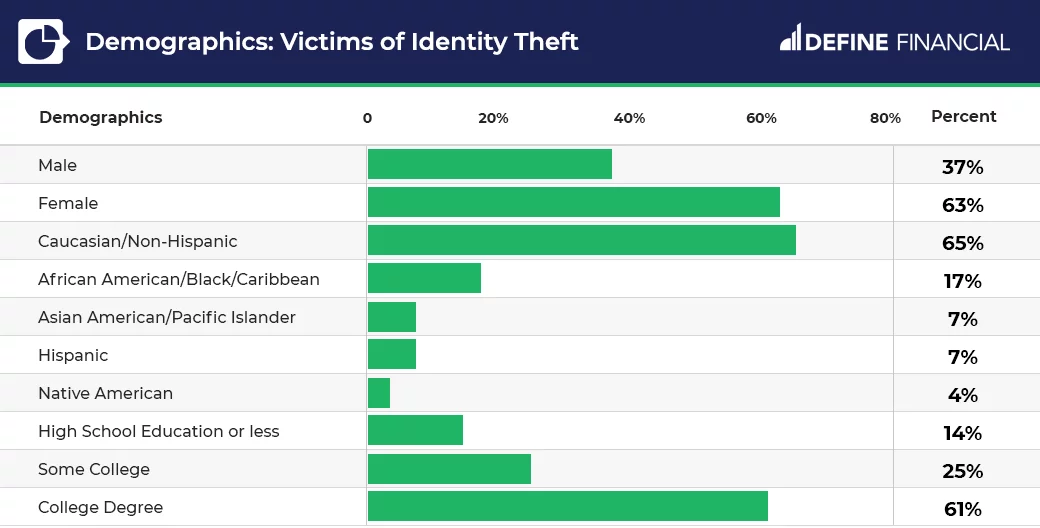

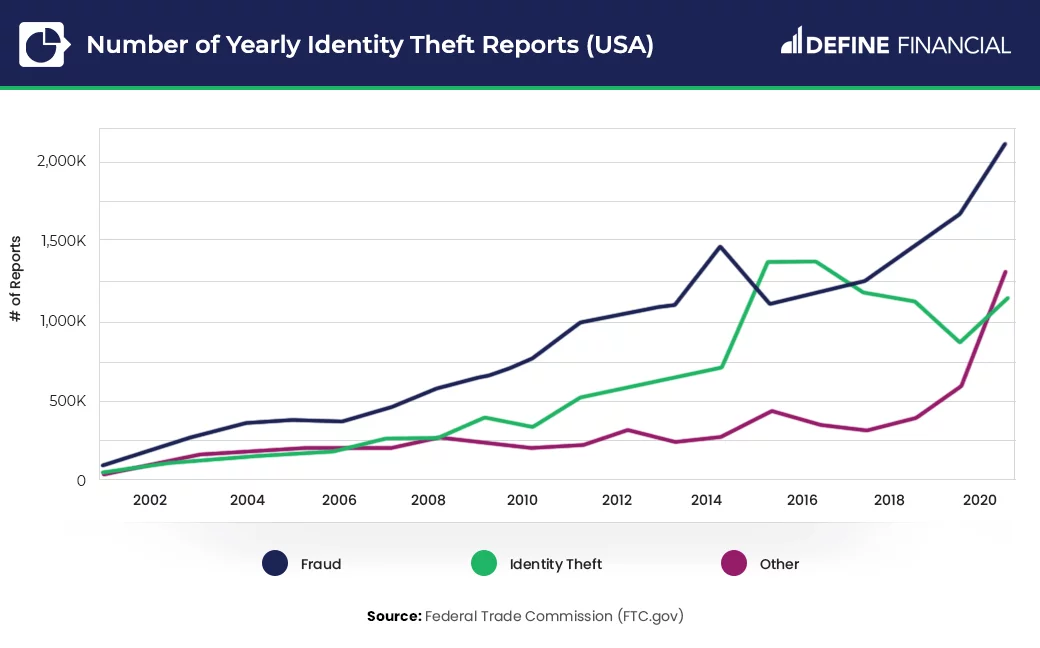

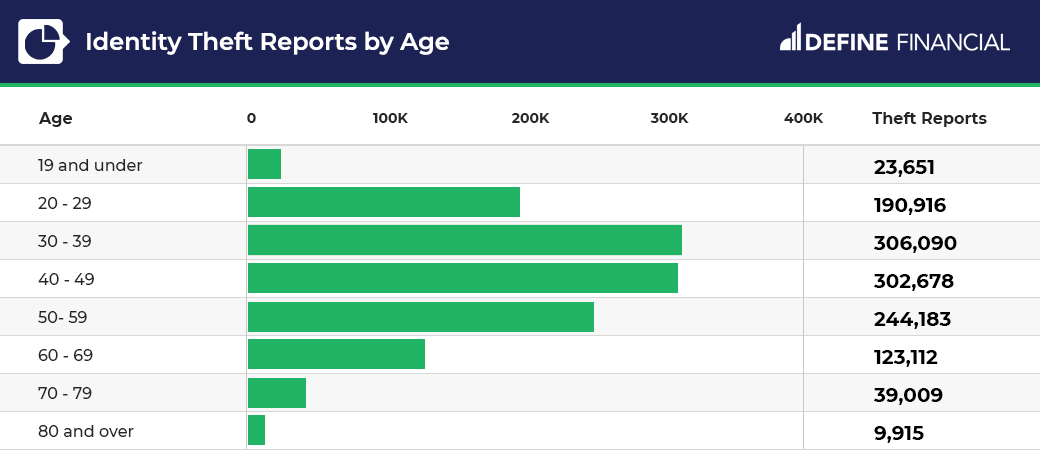

50 Identity Theft Credit Card Fraud Statistics 2022

Get Credit Monitoring More with LifeLock.

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)

. Trust the 1 Most Recognized Brand. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. Stay Informed Protected.

This statement is an attempt to fool the IRS into. Join a Plan Today Starting 899. The IRS state tax agencies and private industry partner to detect prevent and deter tax-related identity theft and fraud.

Our Reviews Are Trusted By 45000000 Consumers. Tax identity theft involves the illicit filing of tax returns using stolen PII. A tax identity theft happens when an imposter uses your personal information in order to file false fraudulent tax returns.

Tax related identity theft occurs in a variety of ways like losing a wallet or purse lost or stolen mail and discarded documents left un-shredded. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. Get Peace of Mind Knowing IdentityIQ Can Help Protect Your Identity.

Informative Free Service. Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return. But perhaps one of the most common.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. The identity thief will use a.

IRS Tax Tip 2019-40 April 11 2019 Tax-related identity theft occurs when a thief uses someones stolen Social Security number to file a tax return and claim a fraudulent. Ad Rated the Top-3 Best Identity Theft Protection Companies Plus Device Protection. Be Safe from Fraudulent Transactions Loans.

This happens if someone uses your Social Security number. Use Strong Authentication and Real-Time Access Policies to Grant Access to Resources. In some cases thieves do this in order to claim a fraudulent tax refund.

You might think youre in the clear because you. Ad Credit Monitoring Can Help You Detect Possible Identity Fraud Sooner And Prevent Surprises. This is done so that the.

Ad Credit Monitoring Locking at Your Fingertips. Tax identity theft whether its with the Internal Revenue Service or your state s Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve. Tax identity theft occurs when someone files a tax return using your Social Security Number SSN.

What to do when someone steals your identity and tax refund Thankfully if the worst happens and someone files taxes using your personal info here are four steps you can. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. Ad Access IRS Tax Forms.

Tax identity theft happens when someone uses your personal informationto file a tax return claiming the fraudulent returns are yours. Compare ID Theft Protection Services. Complete Edit or Print Tax Forms Instantly.

Most criminals who commit tax fraud steal their victims tax benefits and refunds so they often execute attacks. Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund.

Free Monitoring Of Your Experian Credit Report With Alerts When Key Changes Occur. Get Credit Monitoring More with LifeLock. Stay Informed Protected.

According to the IRS Taxpayer Guide To ID Theft there are 8 likely scenarios that might indicate your identity has been compromised. Ad Make the Right Choice With the Help Of Our Listings. Phishing and Online Scams.

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that. Identity Theft happens to 1 Out of 4.

Dont Be That One. The IRS doesnt initiate contact. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

You receive a letter from the IRS inquiring about a. Ad Have Full Control of Your Credit Activity. Ad Guard Against Breaches of Lost or Stolen Credentials with Password Protection.

People often discover tax identity theft when they file their tax returns.

.png)

The 15 Types Of Identity Theft You Need To Know 2022 Aura

How Does Identity Theft Happen Equifax

What Is Tax Related Identity Theft And How Can You Recover From It

50 Identity Theft Credit Card Fraud Statistics 2022

What Is Digital Identity Theft Bitdefender Cyberpedia

How Does Identity Theft Happen Equifax Canada

Tax Identity Theft American Family Insurance

How Do You Check For Identity Theft Experian

50 Identity Theft Credit Card Fraud Statistics 2022

Learn About Identity Theft And What To Do If You Become A Victim

What Is Identity Theft Identity Fraud Vs Identity Theft Fortinet

Ghost Fraud Identity Theft Of A Deceased Person

How Common Is Tax Identity Theft Experian

Types Of Identity Theft Equifax

Types Of Identity Theft And Fraud Experian

25 Warning Signs Of Identity Theft Don T Fall Victim In 2022 Aura